Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

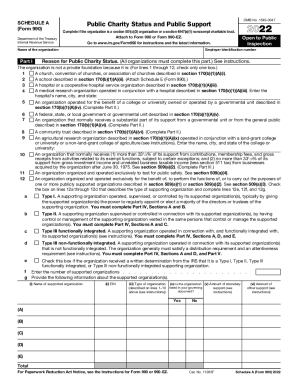

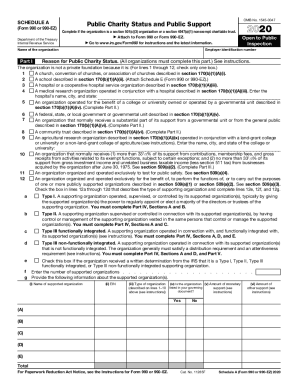

What is irs form schedule h?

IRS Form Schedule H is a form used to report income, expenses, and credits related to household employment taxes. It is commonly used by employers who have hired household employees, such as nannies, housekeepers, and yard workers. The form must be completed and filed along with a Form 941, Employer's Quarterly Federal Tax Return.

Who is required to file irs form schedule h?

Schedule H (Form 1040) is used by individuals who are required to report taxes on the household employment of household employees. This includes individuals who pay wages of $2,000 or more in a calendar year to any one household employee or who pay wages of any amount to household employees who are subject to federal income tax withholding.

What is the purpose of irs form schedule h?

IRS Form Schedule H is used to report household employment taxes. This form is used to calculate and report employment taxes for individuals who employ household employees, such as nannies, housekeepers, and gardeners.

What information must be reported on irs form schedule h?

On IRS Form Schedule H, employers must report information about their health plan coverage, including the number of employees who received coverage, the number of employees who enrolled in coverage, the total amount of employer contributions to the plan, the number of employees eligible for health coverage, the number of employees who declined coverage, and the total cost of coverage for each plan.

When is the deadline to file irs form schedule h in 2023?

The deadline to file IRS Form Schedule H in 2023 is April 15, 2024.

How to fill out irs form schedule h?

To fill out IRS Form Schedule H, which is the Household Employment Taxes form, follow these steps:

1. Identify yourself: Begin by entering your name and social security number or employer identification number (EIN) at the top of the form.

2. Dependent Information: Provide the name, social security number (or individual taxpayer identification number) of the person you employed, and their relationship to you (e.g., child, spouse, parent, etc.).

3. Wages: Report the total wages you paid to the employee during the tax year. This includes cash wages, as well as the fair market value of non-cash payments such as room or board if applicable.

4. Taxes Withheld: If you withheld federal income tax from your household employee's wages, report the amount withheld in this section.

5. Employment Taxes: Calculate the total social security and Medicare taxes (also known as FICA taxes) owed for the year based on the wages reported earlier. The instructions on Schedule H provide the rates for calculating these taxes.

6. Adjustments: If you or your employee worked only part of the year, you may need to make adjustments to the tax liability. Check the instructions to determine if any adjustments apply to your situation.

7. Tax Payments: Report any federal income tax withheld from your wages in this section. Also, include any advance earned income credit (EIC) payments you made to your employee.

8. Total Household Employment Taxes: Add up the amounts from previous sections to calculate the total household employment taxes owed.

9. Payments and Credit: Enter any other credits or payments made on the employee's behalf, such as federal unemployment (FUTA) tax paid.

10. Balance Due or Overpayment: Compare the total household employment taxes (step 8) with the total payments and credits (step 9) to calculate the balance due or overpayment.

11. Signature and Date: Sign and date the form to certify that the information provided is accurate.

Note: If you need assistance with filling out this form or have complex circumstances, professional tax advice may be helpful.

What is the penalty for the late filing of irs form schedule h?

The penalty for late filing of IRS Form Schedule H (Household Employment Taxes) can vary depending on the circumstances. As of 2021, the penalty for failure to file Schedule H by the due date can be calculated as follows:

1. If the failure to file is within 30 days of the due date: The penalty is 2% of the unpaid tax amount.

2. If the failure to file is more than 30 days but before August 1: The penalty is the greater of $435 or 100% of the unpaid tax amount.

3. If the failure to file is on or after August 1 or due to intentional disregard: The penalty is the greater of $870 or 100% of the unpaid tax amount.

It's important to note that these penalty amounts can change, so it's always recommended to refer to the official IRS sources or consult a tax professional for the most up-to-date information related to penalties.

How can I manage my schedule form h directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your form schedule h and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get how to schedule h?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific online form schedule h and other forms. Find the template you need and change it using powerful tools.

How do I edit schedule h form in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your irs form schedule h, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.